The Ultimate Guide to

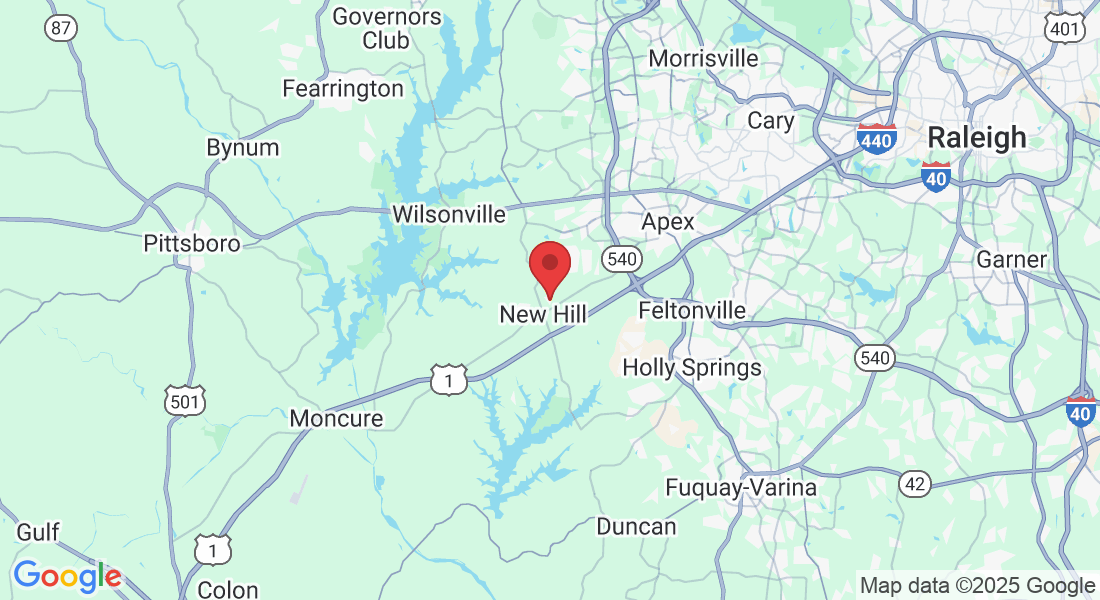

Getting a Mortgage in Wake County, NC

Thinking about buying a home in Wake County? You're in the right place. This guide will walk you through everything you need to know about securing a mortgage in this fast-growing area, from understanding the markets in towns like Apex and Cary to navigating local property taxes and loan limits.

Let's get started.

Understanding the Mortgage Process in Key Towns

While Wake County is a single market, each town has its own unique character and housing landscape. Here’s a look at what to expect in the most popular areas.

Mortgages in Apex & Holly Springs

These towns are consistently ranked among the best places to live in the country, known for being exceptionally family-friendly with great schools and a charming small-town feel despite their rapid growth. The real estate market here is very active, with a mix of established neighborhoods and new construction communities.

Average Home Price: According to recent market data, the median home price in this area hovers around $550,000.

Mortgage Tip: With so much new construction, it's crucial to understand the builder's affiliated lending process. While convenient, their lender may not offer the best rate or terms. As your broker, I can provide a competitive analysis to ensure you're getting the best possible deal, whether it's from the builder's lender or another source.

Mortgages in Cary & Morrisville

Cary and Morrisville are at the heart of the Research Triangle Park (RTP), attracting professionals in tech, research, and healthcare. The lifestyle is diverse and suburban, with excellent amenities and a highly competitive real estate market.

Average Home Price: The market here is robust, with median home prices often reaching $600,000 or more.

Mortgage Tip: In a competitive market like Cary, a simple pre-qualification letter isn't enough. I'll work with you to get a fully underwritten pre-approval. This makes your offer as strong as a cash offer and gives you a significant advantage when negotiating with sellers.

Mortgages in Raleigh

As the state capital and a major cultural hub, Raleigh offers a dynamic mix of vibrant downtown living, historic neighborhoods Inside the Beltline (ITB), and sprawling suburbs. The housing stock is incredibly varied, from historic bungalows to modern high-rise condos.

Average Home Price: Raleigh's diversity is reflected in its home prices, with a median of around $450,000, but this can vary dramatically by neighborhood.

Mortgage Tip: The type of property you buy in Raleigh can affect your mortgage. For example, getting a loan for a condo may require a review of the homeowners' association (HOA) financials. I can help you navigate these specific requirements to ensure a smooth process no matter what type of home you choose.

Wake County Financial Details: What You Need to Know

Navigating Wake County Property Taxes

Your property tax is a key component of your total monthly housing cost, often referred to as PITI (Principal, Interest, Taxes, and Insurance). This amount is collected with your mortgage payment and held in an escrow account to be paid on your behalf.

The Rate: The Wake County property tax rate is a combination of a county rate and a municipal rate. For 2025, the combined rate is approximately $0.654 per $100 of assessed home value.

Example Calculation: For a home assessed at $500,000, the annual property tax would be roughly $3,270, or about $272.50 per month.

Loan Limits for 2025

Loan limits are set by the Federal Housing Finance Agency (FHFA) and determine the maximum loan amount for different types of mortgages.

Conforming Loan Limit: For 2025, the conforming loan limit for a single-family home in Wake County is $776,250. Any loan amount up to this limit is considered a "conforming loan."

Jumbo Loans: If you need to borrow more than the conforming limit, you will need a "jumbo loan." These loans are for higher-priced properties and often have slightly different qualification requirements and interest rates. I can help you determine which loan type is right for your purchase price.

Frequently Asked Wake County Mortgage Questions

What credit score do I need to buy a home in Wake County?

Generally, a FICO score of 620 is the minimum required to qualify for a conventional loan. For government-backed loans like FHA, it may be possible to qualify with a lower score. However, to secure the most competitive interest rates and terms, lenders typically want to see a credit score of 740 or higher. A stronger credit score demonstrates less risk and can save you thousands of dollars over the life of your loan.

Are there down payment assistance programs available?

Yes, there are several excellent programs for homebuyers in North Carolina. The most popular is the NC Home Advantage Mortgage, which can provide eligible first-time and move-up buyers with down payment assistance. There are also programs for veterans and specific municipal grants that can pop up. I am well-versed in these programs and can help you determine if you qualify for assistance.

How long does the closing process take in North Carolina?

On average, the closing process in North Carolina takes between 30 to 45 days. This clock starts the moment your purchase offer is accepted by the seller. During this period, several key steps occur, including the home appraisal, title search, loan underwriting, and your final walkthrough of the property. A well-organized process is key to closing on time without any stress.

"Experience"

The Difference

With over 25 years of mortgage experience, Jason not only has the lowest NMLS # of any active loan officer, he's made it his mission to utilize his decades of real, in the trenches, industry knowledge to empower today's home buyers to help them make the right decisions for themselves.

This unique position & mindset is why you should choose Jason as your loan officer.

Do Rates Really

Even Matter?

The industry wants you to believe that rates are the same from company to company and that "price only matters in the absence of value".

Sorry but the rate determines your payment and therefore it matters a heck of a lot to you... and to us. Fortunately, you can have BOTH!

Great rates & Great Service

Fast Mortgage Approvals & Closings

As soon as you go under contract, the clock starts ticking. Inspections, appraisals, underwriting, conditions to be met; There's much to do and no time to waste.

With literally thousands of mortgages under his belt, Jason understands your timeline and knows when to give you breathing room and when to step on the gas to ensure a fast and easy mortgage process.

About Jason Iacovelli

Sr. Loan Officer, NMLS #3370

Jason has over 20 years of experience in the mortgage and banking industry working previously as a loan officer assistant, loan officer, account manager, regional production manager, account executive, and a branch manager. Over the course of his career, Jason has successfully brought thousands of mortgage applications to closing.

Raised the son of a career Army Soldier, he and his family moved every few years. He was born in Columbia SC and has lived in Stuttgart Germany, Pennsylvania, the Catskill Mountains in Upstate NY, Boston, Westchester, NY and now calls Cary home. He spent his late teenage and early adult years in New York before moving to the Triangle in 2014.

He has a beautiful wife Valerie and they have two adorable children. He loves being a dad and spending quality time with his family. Jason enjoys playing golf, is an admitted movie junkie and is trained in mixed martial arts.

What Our Clients Say

"Jason was great to work with, handled every issue that came up, was quick and very responsive. I highly recommend working with Jason when purchasing a home."

- Blaise Alicki

Apex, NC

Schedule Your Discovery Call

You could spend countless hours scouring every page of our website and many others trying to determine who the best choice for your mortgage is, only to feel more confused and frustrated than you were on day 1.

Set up a call today and on that call, you'll know without any doubt who your mortgage should be handled by. Give us the opportunity to WOW you and you'll never worry about making the right decision again.

305 W Woodard St Suite 220 Denison, TX 75020

Be My Neighbor Mortgage

NMLS #1743790

NMLS Consumer Access Link: click here

© Copyright 2025. TheMortgage.App. All rights reserved.

Debt Does Deals, LLC, doing business as reAlpha Mortgage, is a licensed mortgage broker NMLS #1743790 (www.nmlsconsumeraccess.org).

TheMortgage.App is a marketing brand and not a licensed entity. Jason Iacovelli – Senior Loan Officer – NMLS #3370. Equal Housing Opportunity – We arrange but do not make loans; all loans are arranged through third-party providers.

All loans are subject to credit approval and not all loan programs are available in all states. This is not an offer to extend credit or a commitment to lend. For Texas consumers: Visit the Texas Consumer Complaint Notice for instructions on how to file a complaint with the Texas SML and about the recovery fund.