FAQ

You've got mortgage questions; We've got mortgage answers!

Frequently Asked Questions

The only stupid questions are the ones that don't get asked

Embarking on the mortgage journey can bring up many questions, and it's important to remember that every question is a stepping stone to better understanding. In our FAQ section, you'll find clear, straightforward answers to a wide range of common inquiries, from loan options and eligibility to application processes and repayment terms. We've compiled these questions based on what homeowners like you frequently ask, ensuring you have the information you need at your fingertips. So, go ahead, ask away – because the more you know, the more empowered you are to make the best decisions for your future.

How Can I Choose Between a Fixed-Rate and an Adjustable-Rate Mortgage?

Choosing between a fixed rate mortgage and an adjustable one depends on your financial plans and your timeline. A fixed-rate mortgage keeps the same interest rate and monthly payment throughout the loan term, offering stability. An adjustable-rate mortgage (ARM) may start with a lower rate, but it can change periodically, potentially leading to higher future payments.

What Impact Does My Credit Score Have on Getting a Good Mortgage Rate?

Generally speaking, a higher credit score usually means lower mortgage rates because it indicates less risk to lenders. Improving your credit score before applying can lead to more favorable loan terms, to a point. For the most part, once you go over a 740 credit score, your rates are no different than someone who has an 850 credit score.

As a First-Time Homebuyer, How Much Down Payment Do I Need for a Mortgage?

Down payments vary, typically ranging from 3% to 20%. Programs like VA & USDA loans can offer lower down payment options (like $0 down) but there are restrictions. Your choice depends on your financial situation and the loan type you qualify for.

Can Self-Employed Individuals Easily Qualify for Home Loans?

Yes, but you may need to provide more documentation, like tax returns and profit/loss statements. Lenders will examine your net income, credit history, and debt-to-income ratio. Depending on what you're trying to do, there are alternative programs that allow for more abstract income verification that may be best for some self employed buyers.

How Long Does the Mortgage Application Process Typically Take?

The mortgage application process typically takes between 30 to 45 days from application to closing, depending on various factors like the type of mortgage, your financial situation, and the lender's processing time.

What's the Difference Between Mortgage Pre-Qualification and Pre-Approval?

Pre-qualification is an estimate of how much you can borrow, while pre-approval involves a more in-depth review, including a credit check and documentation, and is more definitive. There's no standard for what constitutes a pre-qualification and for that reason, you should always look to get a full approval done from the start.

What Are Mortgage Closing Costs and How Much Should I Budget for Them?

Closing costs, including appraisal and credit report fees, are typically 2%-5% of your loan amount. They cover the expenses of finalizing your mortgage.

What Documents Do I Need to Apply for a Home Loan?

Along with a bunch of items that will vary based on your circumstances, the standard items you’ll need are proof of income (like pay stubs), tax returns, bank statements, and valid ID. These documents help lenders assess your loan eligibility.

Local Contact Info

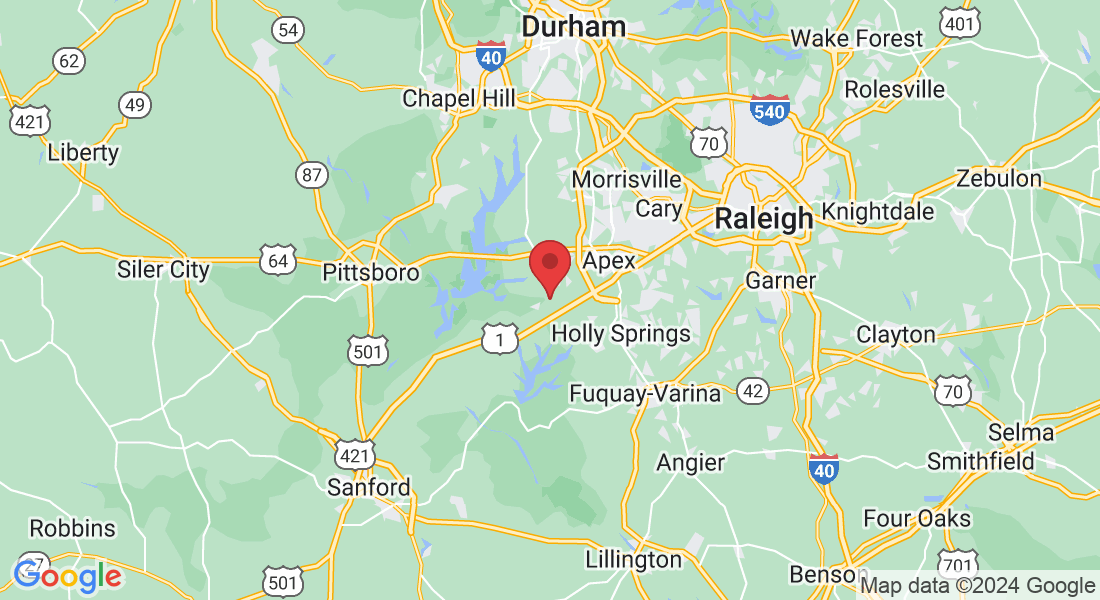

Jason Iacovelli, NMLS #3370

Sr. Loan Officer

3149 Zebroid Way

New Hill, NC 27562

Call or Text: 919-646-6869

3100 W. Ray Rd, Ste 201, Office # 209

Chandler, AZ 85226

NEXA Mortgage NMLS #1660690

NMLS Consumer Access Link: click here

© Copyright 2025. TheMortgage.App. All rights reserved.

Debt Does Deals, LLC, doing business as reAlpha Mortgage, is a licensed mortgage broker NMLS #1743790 (www.nmlsconsumeraccess.org).

TheMortgage.App is a marketing brand and not a licensed entity. Jason Iacovelli – Senior Loan Officer – NMLS #3370. Equal Housing Opportunity – We arrange but do not make loans; all loans are arranged through third-party providers.

All loans are subject to credit approval and not all loan programs are available in all states. This is not an offer to extend credit or a commitment to lend. For Texas consumers: Visit the Texas Consumer Complaint Notice for instructions on how to file a complaint with the Texas SML and about the recovery fund.