VA Loans:

Explore the benefits of VA Loans, a unique offering at the heart of our commitment to serving those who have served our country.

With advantageous terms and specific eligibility requirements, VA Loans provide an excellent pathway to homeownership for veterans, active-duty service members, and certain members of the National Guard and Reserves.

What Is A VA Mortgage?

Unlocking Homeownership for Veterans and Military Families

A VA Loan is more than just a mortgage option—it’s a benefit earned through service. Backed by the U.S. Department of Veterans Affairs, VA Loans offer significant advantages over traditional loans, making it easier for military families to buy or refinance a home.

Benefits of VA Loans

VA Loans come packed with features designed to make homeownership accessible and affordable:

No Down Payment Required:

One of the most significant benefits is the ability to finance 100% of the home’s value without a down payment, a rarity in the mortgage landscape.No Private Mortgage Insurance (PMI):

Unlike conventional loans, VA loans do not require PMI, which can lower your monthly payments considerably.

Competitive Interest Rates:

Typically, VA loans come with lower interest rates compared to traditional loans, reducing your monthly expenses.

Flexible Credit Requirements:

The credit requirements for VA loans are generally more flexible, making them accessible to more borrowers.

Who Is Eligible For A VA Home Loan?

Eligibility for VA Loans is based on service duration and duty status. To qualify, you must be:

An active-duty service member or honorably discharged veteran who meets specific service durations.

A spouse of a service member who died in the line of duty or as a result of a service-related injury.

Check your eligibility and gather more information on what documents you'll need by visiting our

How To Apply For A VA Loan

Get started on your home buying mission

Applying for a VA Loan involves several steps, including obtaining a Certificate of Eligibility (COE), which proves to lenders that you meet the necessary service requirements. Our team is here to guide you through the application process, ensuring you understand every step and meet all requirements. Start your VA mortgage application process here.

Why Choose a VA Loan?

The undisputed champ of mortgage options

For many veterans and active-duty military personnel, a VA Loan is the best path to homeownership. It eliminates many of the financial barriers that can hinder other borrowers, such as down payments and high interest rates.

Moreover, the absence of PMI can save hundreds of dollars monthly, providing financial relief and the freedom to invest in your future.

Explore Your Options

know all your options before making that decision

Interested in learning more about how a VA Loan can help you achieve your dream of homeownership? Visit our comprehensive Loan Programs page for detailed insights, or contact our experts directly.

While the VA mortgage is one of the best mortgage programs of all time, we still feel it's important to know all your options to ensure a VA loan is best suited for you and your plans & goals. Don't worry. We're here to help you navigate your home buying journey with the benefits you've earned through your valued service.

FAQs About FHA Loans

Q: What are the specific benefits of a VA Loan compared to other types of mortgages?

VA Loans offer several distinct advantages over traditional mortgage options. The most significant benefits include no down payment requirement, no private mortgage insurance (PMI), lower interest rates, and lenient credit requirements. These features can make homeownership more accessible and affordable for military families.

Q: Who is eligible for a VA Loan?

VA Loans are available to active-duty service members, veterans, members of the National Guard and Reserve who meet specific service requirements, and some surviving spouses of service members who died in the line of duty or from a service-connected disability.

Eligibility is determined based on service duration, duty status, and discharge conditions. Applicants are required to obtain a Certificate of Eligibility (COE) to prove their eligibility to lenders.

Q: Can VA Loans be used for refinancing a home?

Yes, VA Loans can also be used for refinancing an existing mortgage through the VA Streamline Refinance Program (also known as the Interest Rate Reduction Refinance Loan, or IRRRL) and the VA Cash-Out Refinance Program. The IRRRL is a simplified process designed to lower your interest rate or convert an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

The VA Cash-Out Refinance Program allows borrowers to refinance their conventional or VA loan and take out cash from the home's equity. This can be used for home improvements, debt consolidation, or other financial needs.

Are you "Eligible" Enough?

find out your va benefit with a few quick clicks

Taking the Next Step

How do you know if a VA mortgage is right for you?

Ready to explore VA loans? They offer a practical route into homeownership with manageable requirements and costs. Whether you're buying your first home or looking to leverage your VA benefits, start by reaching out to our team of expert mortgage loan originators.

While it's important that you know there are options available to you, you can't be expected to know all the ins and outs of every loan program. Fortunately, that's our job. Our loan officers will go over all of the options available to you to help you decide which loan program is the ideal fit for your situation.

Ready to make the leap from endlessly scrolling through Zillow to holding those shiny new keys?

Click or scan that perky little "Get Started" QR Code (you know you want to), or go old-school and give us a ring at 919.646.6869. Because calling someone is so... intimate. Scheduling appointments is the new flirting, didn’t you know? 😉

About Jason Iacovelli

Your Favorite loan officer's favorite loan officer

With over 20 years in the mortgage industry and a rich history of roles—from loan officer to branch manager—Jason has seen thousands of mortgage deals through to closing. A globe-trotter since childhood, he has roots in South Carolina but has called many places home, including Germany and New York, before settling in Cary in 2014.

At home, Jason is a dedicated husband to Valerie and doting father to two. When he's not closing deals or enjoying family time, he's likely on the golf course, catching up on films, working out & practicing mixed martial arts (a hobby he absolutely loves but was absolutely terrible at).

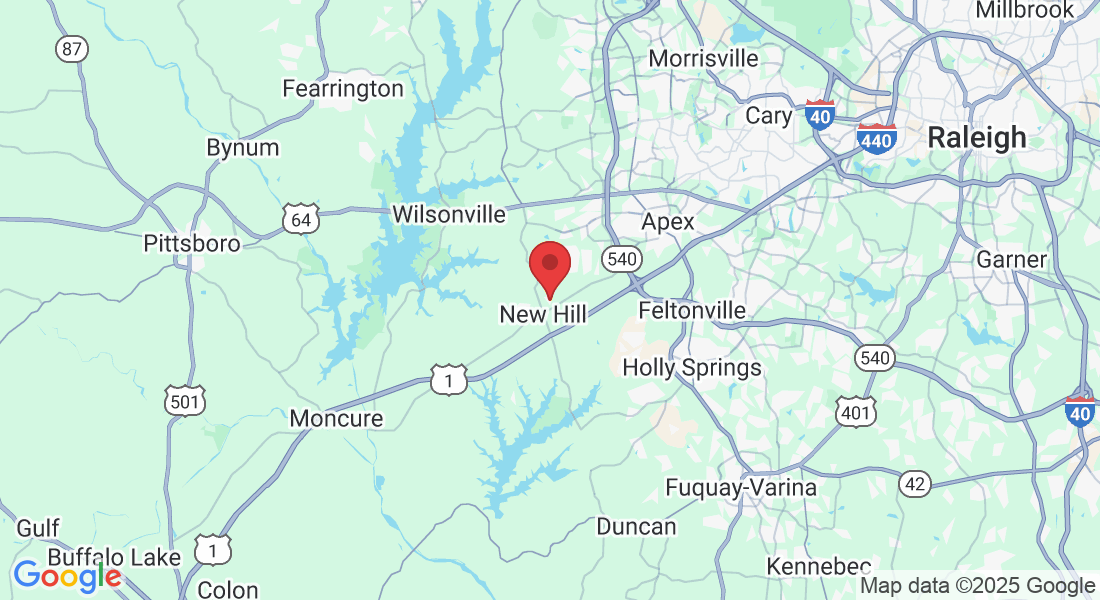

Local Contact Info

Jason Iacovelli, NMLS #3370

Sr. Loan Officer

3149 Zebroid Way

New Hill, NC 27562

Call or Text: 919-646-6869

3100 W. Ray Rd, Ste 201, Office # 209

Chandler, AZ 85226

NEXA Mortgage NMLS #1660690

NMLS Consumer Access Link: click here

© Copyright 2025. TheMortgage.App. All rights reserved.

Debt Does Deals, LLC, doing business as reAlpha Mortgage, is a licensed mortgage broker NMLS #1743790 (www.nmlsconsumeraccess.org).

TheMortgage.App is a marketing brand and not a licensed entity. Jason Iacovelli – Senior Loan Officer – NMLS #3370. Equal Housing Opportunity – We arrange but do not make loans; all loans are arranged through third-party providers.

All loans are subject to credit approval and not all loan programs are available in all states. This is not an offer to extend credit or a commitment to lend. For Texas consumers: Visit the Texas Consumer Complaint Notice for instructions on how to file a complaint with the Texas SML and about the recovery fund.