Refinance Mortgage Loans:

Refinancing your mortgage offers a strategic opportunity to adjust your loan's terms to your current financial situation, potentially leading to savings and increased financial flexibility.

Understanding Refinance Options

Refinancing: A Comprehensive Guide to Enhancing Your Mortgage Terms

Refinancing your mortgage can be a smart financial decision, offering an opportunity to adjust your loan's terms to better match your current needs and future goals. Whether you're looking to lower your monthly payments, shorten your loan term, or access the equity built up in your home for large expenses, it's important to understand the various refinance options available to you. Our comprehensive guide aims to demystify the refinancing process, ensuring you're equipped with the information needed to choose the best path forward.

Make the Smart Move with Our Mortgage Refinancing Solutions

Lower your monthly payments, tap into your home equity, or shorten your loan term with our competitive refinance mortgage loans designed for modern homeowners like you.

Experience the Difference in Refinancing Your Home

Unlock the Door to Savings

Are you paying more than you need to on your mortgage? Don't settle for high-interest rates when you can easily switch to more affordable terms. With our exceptional Mortgage Refinancing services, empower yourself with rates that add to your life, not just your monthly bills.

Tailored Plans That Fit Your Life

Your financial goals are as unique as your home. That's why we offer a Home Loan Refinance service that aligns with what you value most—whether it's consolidating debt, reducing monthly payments, or freeing up cash for life's demands.

Simplifying the Refinance Journey

Wave goodbye to complex processes and welcome a simplified mortgage refinancing experience. Our dedicated team of experts is here to guide you through every step, ensuring you understand the path ahead. Minimal paperwork means more time for you to enjoy the home you love.

Professional Advice You Can Trust

Navigate your refinancing options with confidence alongside our seasoned mortgage professionals. They're here to share insights, answer your questions, and show you how to lower interest rates without the runaround.

Discover Your Best Rate

Stop wondering about "today's mortgage refinance rates" and get a personalized rate that reflects your credit, equity, and financial aspirations. Fast approvals and efficient funding get you from "just browsing" to "saving seriously" quicker than you can pack a moving box.

Transparency Is Our Commitment

We pledge full transparency throughout your refinancing process. Get all your questions answered, from "can you refinance a home equity loan into a mortgage?" to "what is a cash-out refinance mortgage loan?" We're committed to helping you make informed decisions that benefit your future.

Ready to Refinance?

Take control of your mortgage and your future. Visit us today to explore your options or speak with a consultant who can tailor a solution just for you. Click here to get started or keep scrolling to learn more about refinancing your mortgage.

Key Terms of Refinancing

What is Refinancing

Refinancing, in its essence, is the process of replacing an existing mortgage with a new loan, typically under different terms. The main reasons homeowners opt to refinance are to obtain a lower interest rate, reduce monthly payments, adjust the term length of the mortgage, or access equity for large purchases. This strategic financial move can result in significant savings over time, provided it aligns with the homeowner's goals and current financial situation. Understanding when and how to leverage refinancing can dramatically reshape an individual's financial landscape, enhancing their ability to meet long-term objectives and improve overall financial health.

Diving into the world of mortgage refinancing can feel like learning a new language. Here are some key terms that will help clear the fog and make the process more understandable:

Fixed-Rate Mortgage:

A loan where the interest rate remains the same for the entire repayment term, providing predictability in your monthly payments.Adjustable-Rate Mortgage (ARM):

This type of mortgage has an interest rate that can change over time based on market conditions, which might lead to fluctuations in your monthly payments.Equity:

The value of your home minus the amount you still owe on your mortgage. Building equity can open the door to refinancing options such as cash-out refinance loans.

Cash-Out Refinance:

A refinancing option that allows you to obtain a new mortgage for more than you owe on your home and take the difference in cash, typically for home improvements, debt consolidation, or other major expenses.Rate-and-Term Refinance:

This type of refinancing involves changing the interest rate, the term, or both, of your existing loan without advancing new money.Loan-to-Value Ratio (LTV):

A metric used by lenders to assess the risk of a loan, calculated by dividing the mortgage amount by the appraised home value. A lower LTV ratio often results in a better interest rate.Prepayment Penalty:

A fee that some lenders charge if you pay off your loan early, either through refinancing or by making large lump-sum payments.

Understanding these terms can empower you to make informed decisions and find a refinancing option that best suits your financial goals.

Jumbo Loans vs. Conventional and FHA Mortgages

Unlike their conventional and FHA counterparts, jumbo loans cater to an exclusive market by offering financing solutions for those aiming beyond standard loan ceilings.

Conventional loans are bound by set limits and are generally more accessible than jumbo loans, especially to first-time homebuyers. FHA loans are known for favoring those with lower credit scores and minimal down payments.

However, jumbo loans necessitate a higher borrower standard, including a pristine financial record and substantial capital up-front. While jumbo mortgage rates can climb higher due to the increased lending risk, the borrowing terms are often more adaptable.

Frequently Asked Questions

Q: What does the refinancing process involve?

The refinancing process typically involves applying for a new loan that replaces your current mortgage. This process begins with evaluating your financial goals, checking your credit score, and understanding the equity in your home. After choosing a lender, you'll submit an application, undergo a home appraisal, and finally, close on the new loan. Throughout, it's crucial to compare offers and understand all associated costs.

Q: How do I know if refinancing is right for me?

To determine if refinancing is a beneficial choice, consider your financial goals, the current market interest rates, and how long you plan to stay in your home. Refinancing can lower your monthly payments, shorten your loan term, or provide cash for large purchases.

However, it's also important to factor in closing costs and how they may impact your overall savings. Consulting with a mortgage professional can provide personalized advice based on your situation.

Q: Can I refinance with bad credit?

While having a higher credit score can provide access to better interest rates, refinancing is not exclusively for those with excellent credit. Lenders offer various loan products tailored to different credit profiles. However, be prepared that with a lower credit score, the terms might not be as favorable, and the interest rates might be higher. Taking steps to improve your credit score before applying can enhance your chances of receiving a better loan offer.

Refinancing, in its essence, is the process of replacing an existing mortgage with a new loan, typically under different terms. The main reasons homeowners opt to refinance are to obtain a lower interest rate, reduce monthly payments, adjust the term length of the mortgage, or access equity for large purchases.

This strategic financial move can result in significant savings over time, provided it aligns with the homeowner's goals and current financial situation. Understanding when and how to leverage refinancing can dramatically reshape an individual's financial landscape, enhancing their ability to meet long-term objectives and improve overall financial health.

Are You Ready Take Control of Your Financial Future?

Wait!... Don't Refinance Now. First Find Out Your Options So You Can Make The Best Decision For You & Your Family!

Click or scan that perky little "Get Started" QR Code (you know you want to), or go old-school and give us a ring at 919.646.6869. Because calling someone is so... intimate. Scheduling appointments is the new flirting, didn’t you know? 😉

About Jason Iacovelli

Your Favorite loan officer's favorite loan officer

With over 20 years in the mortgage industry and a rich history of roles—from loan officer to branch manager—Jason has seen thousands of mortgage deals through to closing. A globe-trotter since childhood, he has roots in South Carolina but has called many places home, including Germany and New York, before settling in Cary in 2014.

At home, Jason is a dedicated husband to Valerie and doting father to two. When he's not closing deals or enjoying family time, he's likely on the golf course, catching up on films, working out & practicing mixed martial arts (a hobby he absolutely loves but was absolutely terrible at).

Local Contact Info

Jason Iacovelli

Sr. Loan Officer

NMLS #3370

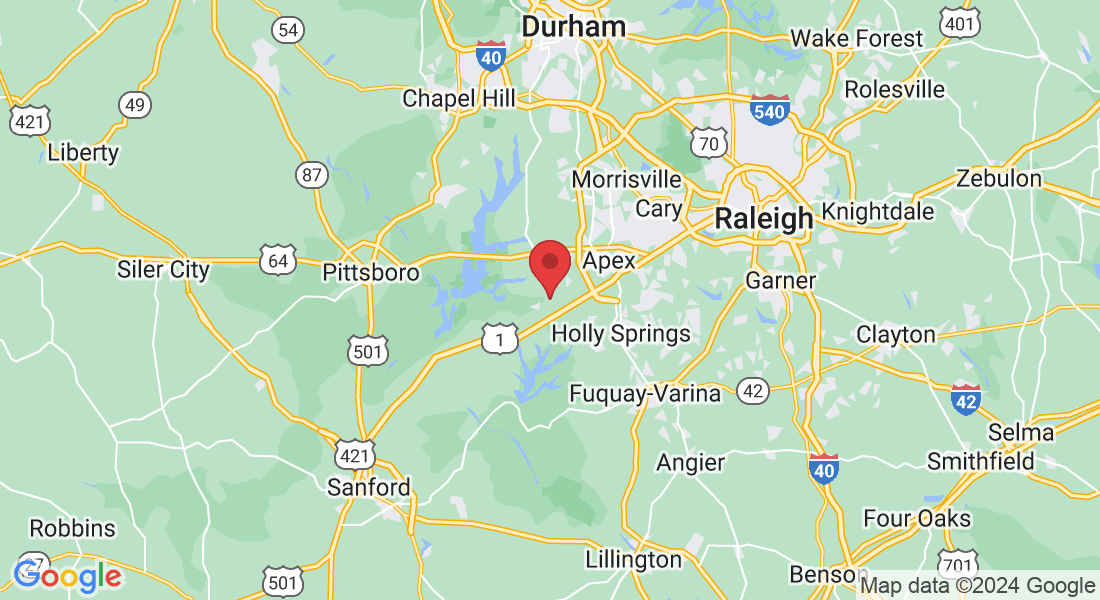

3149 Zebroid Way

New Hill, NC 27562

Call or Text: 919-646-6869

Copyright ©2024 | Axen Mortgage NMLS #1660690 AZMB #0944059 Dallas NMLS #2249747

Licensed to Do Business in the State of AZ, AR, AL, CA, CO, DE, GA, HI, ID, IA, IL, KY, KS, LA, MO, MN, MD, MS, MT, NE, ND, NV, OK, OH, TX, TN, UT, WY, WI

© Copyright 2025. TheMortgage.App. All rights reserved.

Debt Does Deals, LLC, doing business as reAlpha Mortgage, is a licensed mortgage broker NMLS #1743790 (www.nmlsconsumeraccess.org).

TheMortgage.App is a marketing brand and not a licensed entity. Jason Iacovelli – Senior Loan Officer – NMLS #3370. Equal Housing Opportunity – We arrange but do not make loans; all loans are arranged through third-party providers.

All loans are subject to credit approval and not all loan programs are available in all states. This is not an offer to extend credit or a commitment to lend. For Texas consumers: Visit the Texas Consumer Complaint Notice for instructions on how to file a complaint with the Texas SML and about the recovery fund.