Jumbo Mortgages

Let's Dive Into Jumbo Home Loans and See What Makes Them Different From Conventional Mortgages

Understanding Jumbo Loans

A Guide for High-Value Home Financing

Are you considering a high-end real estate purchase and the conventional loan limits just don't cut it? Enter the realm of jumbo loans, a type of financing that allows you to secure your dream home without the constraints of traditional mortgages. Here, we guide high net worth individuals, luxury home buyers, real estate professionals, and financial advisors through the essentials of jumbo loans and how they can be the key to unlocking the door to high-value properties.

Key Features of Jumbo Loans

Larger Loan Amounts

Jumbo loans stand out because they exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA), empowering borrowers with the financial backing to invest in luxury properties and homes in high-cost living areas.

Designed for High-Value Homes

These loans are the go-to solution when you're eyeing a stately manor in the premium neighborhoods that radiate opulence and grandeur. Whether it's a sprawling estate or a penthouse with a skyline view, jumbo loans ensure your aspirations don't have a ceiling.

Higher Credit Score and Down Payment

When it comes to jumbo home loan, financial prowess is key. Borrowers typically need a higher credit score and a larger down payment with jumbo mortgages, reflecting a commitment to financial responsibility and investment strength.

Fixed or Adjustable Interest Rates

Providing financial flexibility, jumbo mortgage rates can be fixed or adjustable. This means you can choose a stable payment structure or take advantage of potential lower rates, depending on your economic outlook and preferences.

The more financially savvy decision between your typical fixed or adjustable rates is to utilize a program like our UnMortgage program which provides the best of both worlds.

A More Rigorous Application Process?

Securing a jumbo loan may require a more rigorous application process, but this hurdle is less daunting when you're well-prepared with a comprehensive view of your financial history and assets.

It also doesn't hurt to have a loan officer on your side that doesn't take chances and asks for the vast majority of documentation upfront. That alone will cut down on the annoyances of the jumbo mortgage application process.

Jumbo Loans vs. Conventional and FHA Mortgages

Unlike their conventional and FHA counterparts, jumbo loans cater to an exclusive market by offering financing solutions for those aiming beyond standard loan ceilings.

Conventional loans are bound by set limits and are generally more accessible than jumbo loans, especially to first-time homebuyers. FHA loans are known for favoring those with lower credit scores and minimal down payments.

However, jumbo loans necessitate a higher borrower standard, including a pristine financial record and substantial capital up-front. While jumbo mortgage rates can climb higher due to the increased lending risk, the borrowing terms are often more adaptable.

How to Qualify for a Jumbo Mortgage Loan

Prospective buyers looking to qualify for a jumbo loan should prepare for an in-depth glance into their financial lives, including:

Credit Score: A lofty credit score is your ticket to favorable jumbo loan conditions.

Down Payment: Heftier than usual, this upfront payment demonstrates financial robustness.

Debt-to-Income Ratio: Lenders will pay meticulous attention to this indicator of financial health.

Documentation: Be ready with detailed records—from W-2 forms to bank statements.

Frequently Asked Questions

Q: What is the difference between a jumbo loan and a conventional loan?

A jumbo loan exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA), making it a suitable option for financing luxury properties or homes in high-cost areas. In contrast, conventional loans adhere to these limits and cater to a broader spectrum of property types and buyer situations. Consequently, jumbo loans demand higher credit scores, larger down payments, and more rigorous financial scrutiny.

Q: Can I get a jumbo loan with a fixed interest rate?

Yes, jumbo loans offer the flexibility of choosing between fixed or adjustable interest rates. Fixed-rate jumbo mortgages provide the security of a consistent payment throughout the loan term, appealing to borrowers looking for stability in their financial planning.

(There are other adjustable rates that can adjust as often as every month... and they're better! But that's a story for another day.)

Q: What factors do lenders consider when approving a jumbo loan application?

Lenders evaluate several key factors when considering a jumbo loan application, including the borrower's credit score, down payment size, debt-to-income ratio, and financial documentation. A high credit score and substantial down payment are essential, demonstrating the borrower's financial strength and commitment. Additionally, lenders meticulously review the borrower's financial health through their debt-to-income ratio and require extensive documentation, such as W-2 forms and bank statements, to ensure the borrower's ability to manage the larger loan.

Jumbo loans fulfill a special role in the mortgage landscape, offering ample resources for those looking to ascend to higher property echelons. With their substantial loan limits and tailored terms, they're an essential tool for discerning buyers with sights set on the extraordinary.

For specialized assistance and to explore how jumbo loans can serve your property investments, reach out to our experts who are ready to help you secure the perfect mortgage solution.

If you're ready to learn more like "What is a jumbo mortgage loan?", our comprehensive resources can guide you through jumbo mortgage rates, jumbo loan limits, and the essential criteria on how to qualify for a jumbo mortgage.

Contact us for tailored advice suited to your fiscal blueprint.

Ready to make the leap from endlessly scrolling through Zillow to holding those shiny new keys?

Click or scan that perky little "Get Started" QR Code (you know you want to), or go old-school and give us a ring at 919.646.6869. Because calling someone is so... intimate. Scheduling appointments is the new flirting, didn’t you know? 😉

About Jason Iacovelli

Your Favorite loan officer's favorite loan officer

With over 20 years in the mortgage industry and a rich history of roles—from loan officer to branch manager—Jason has seen thousands of mortgage deals through to closing. A globe-trotter since childhood, he has roots in South Carolina but has called many places home, including Germany and New York, before settling in Cary in 2014.

At home, Jason is a dedicated husband to Valerie and doting father to two. When he's not closing deals or enjoying family time, he's likely on the golf course, catching up on films, working out & practicing mixed martial arts (a hobby he absolutely loves but was absolutely terrible at).

Local Contact Info

Jason Iacovelli, NMLS #3370

Sr. Loan Officer

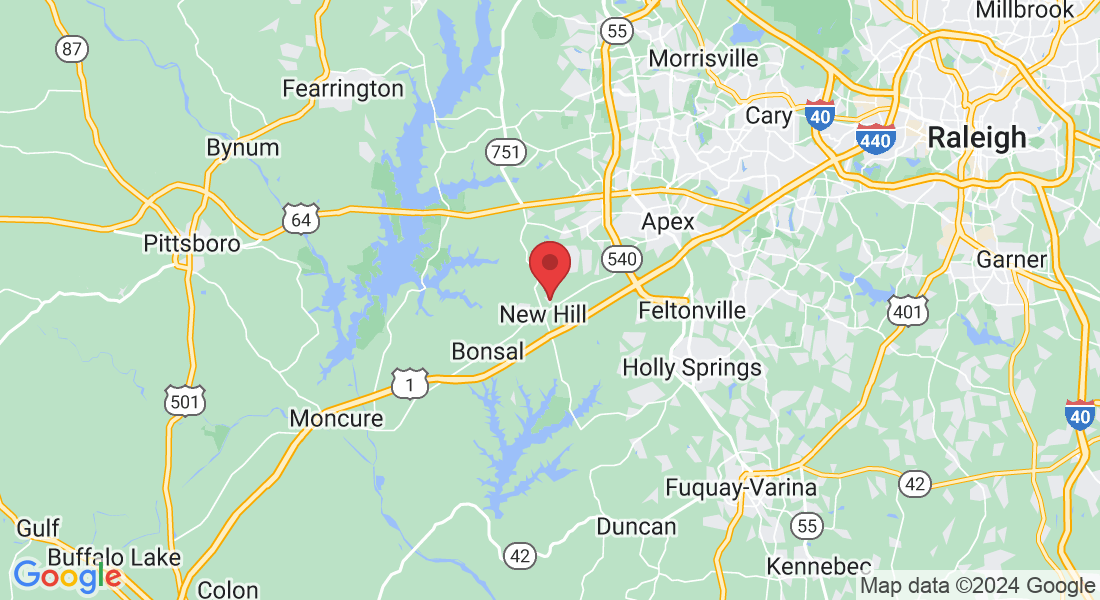

3149 Zebroid Way

New Hill, NC 27562

Call or Text: 919-646-6869

3100 W. Ray Rd, Ste 201, Office # 209

Chandler, AZ 85226

NEXA Mortgage NMLS #1660690

NMLS Consumer Access Link: click here

© Copyright 2025. TheMortgage.App. All rights reserved.

Debt Does Deals, LLC, doing business as reAlpha Mortgage, is a licensed mortgage broker NMLS #1743790 (www.nmlsconsumeraccess.org).

TheMortgage.App is a marketing brand and not a licensed entity. Jason Iacovelli – Senior Loan Officer – NMLS #3370. Equal Housing Opportunity – We arrange but do not make loans; all loans are arranged through third-party providers.

All loans are subject to credit approval and not all loan programs are available in all states. This is not an offer to extend credit or a commitment to lend. For Texas consumers: Visit the Texas Consumer Complaint Notice for instructions on how to file a complaint with the Texas SML and about the recovery fund.