FHA Mortgages:

FHA (Federal Housing Administration) loans are designed to make homeownership more accessible. They are particularly beneficial for first-time homebuyers and those with lower credit scores.

Understanding FHA Loan Options

An Introduction to FHA Loans

FHA loans, provided by the Federal Housing Administration, are crafted to lower the barriers to homeownership. They are especially advantageous for first-time homebuyers and individuals with less-than-perfect credit scores. By requiring lower down payments and accepting lower credit scores, FHA loans open the door to homeownership for a broader segment of the population, making them a vital resource for those who might find traditional lending requirements prohibitively strict.

Benefits of FHA Mortgages

Minimal Down Payments:

The typical down payment is just 3.5%, significantly lower than many conventional loan programs. However, most people do not realize that there are FHA loan programs that require 0% down, making them exceptionally accessible.Flexible Credit Requirements:

FHA loans are accommodating for individuals with lower credit scores. The usual requirement with most lenders is 620 with many starting to go down to a 580 score. With TheMortgage.App at Canopy Mortgage, our programs are available to home buyers with scores all the way down to 500! This flexibility makes homeownership achievable for a broader group of people who may not qualify for other types of loans.Government-Backed Security:

Being backed by the Federal Housing Administration, FHA loans offer lenders security, which in turn can result in more favorable loan terms for borrowers, including competitive interest rates.

How FHA Loans Work

Streamlining Homeownership: How FHA Loans Open Doors for Buyers

FHA loans are tailored to simplify homeownership, making it more attainable for first-time buyers and those with modest credit scores. These loans are appealing because they allow very low down payments, starting as low as 0% for some qualified buyers, with a more typical requirement being just 3.5%. This feature makes entering the housing market more accessible than many conventional loan options.

The backing from the Federal Housing Administration provides lenders with a layer of security, enabling them to offer loans with competitive interest rates and more favorable terms. This government support helps reduce the financial burden on borrowers, making monthly payments more affordable and reducing the overall cost of financing a home.

Qualifying for an FHA Loan

Meeting the Criteria: Navigating FHA Loan Qualifications

Qualifying for an FHA loan is feasible for a wide range of potential homeowners due to its inclusive criteria. Applicants typically need a minimum credit score of 580 to qualify for the low down payment advantage of 3.5% (or even 0%!).

Those with credit scores between 500 and 579 may still qualify, but a higher down payment of 10% may be required. The FHA also permits down payments to come from savings, gifts from family members, or grants, providing flexibility in funding.

Additionally, applicants must have a debt-to-income ratio (DTI) that does not exceed 43%, although exceptions can go up to 50% with strong compensating factors.

Proof of stable income and employment verification are crucial to demonstrate the ability to sustain mortgage payments. These accessible requirements are designed to help more individuals step into homeownership comfortably and sustainably.

FHA Loan Costs

Understanding FHA Loan Costs: An Overview

The costs associated with FHA loans include both upfront and ongoing fees, which are essential for potential borrowers to understand. At the outset, borrowers are required to pay an upfront mortgage insurance premium (UFMIP), which is typically 1.75% of the loan amount and can be financed into the mortgage.

In addition to the UFMIP, there is an annual mortgage insurance premium (MIP) that varies based on the loan amount, term, and loan-to-value ratio, and is paid monthly. This insurance is crucial as it protects lenders from losses in the event of a default, but it increases the overall cost of the loan.

Understanding these fees is vital for calculating the total cost of an FHA loan and planning financial commitments accordingly. Your loan officer will handle all of the calculations for you but having a general understanding goes a long way.

NOTE: In 2024 FHA lowered it's annual MIP factor significantly from 0.85 on down payments less than 5% to 0.55. This savings has already helped thousands of families to get into a home they wouldn't have qualified for a few months ago.

Streamlining the Application Process for FHA Loans

Let's dive into the process for FHA loans

Embarking on the FHA loan application process involves several key steps to ensure you meet the necessary criteria for approval. Initially, it's important to review your financial health by checking your credit score and assessing your overall financial situation, ensuring it aligns with FHA requirements.

Gathering essential documents is next, which (like all loan programs) includes proof of income, employment verification, and any other relevant financial information.

With these documents, you can approach FHA-approved lenders to formally begin the application process. This structured approach helps streamline the application, making it more manageable and likely to result in a successful loan approval.

FAQs About FHA Loans

Q: What makes FHA loans different from conventional loans?

FHA loans are easier to qualify for because they have lower down payment requirements and accept lower credit scores than conventional loans. This makes them ideal for first-time homebuyers or those with less-than-perfect credit histories.

Q: Can I buy ANY home with an FHA loan?

Like most of the residential lending world, FHA loans are only eligible on condos, townhomes, and 1 to 4 family residences. In the case of FHA mortgages, the buyer will have to plan to live in the home as well.

Sorry, but they don't allow true investment properties, however, you can buy a 2 to 4 family house, live in 1 unit and rent out the rest. This strategy has helped many break into the world of real estate investing as they've gone from a 4 family to a 3 unit to 2 and eventually into a single family home.

The property purchased with an FHA loan must meet certain safety and livability standards as per FHA's requirements. This ensures the property is a sound investment. Properties must be evaluated by an FHA-approved appraiser to ensure these standards are met.

Q: What are the limits of an FHA loan?

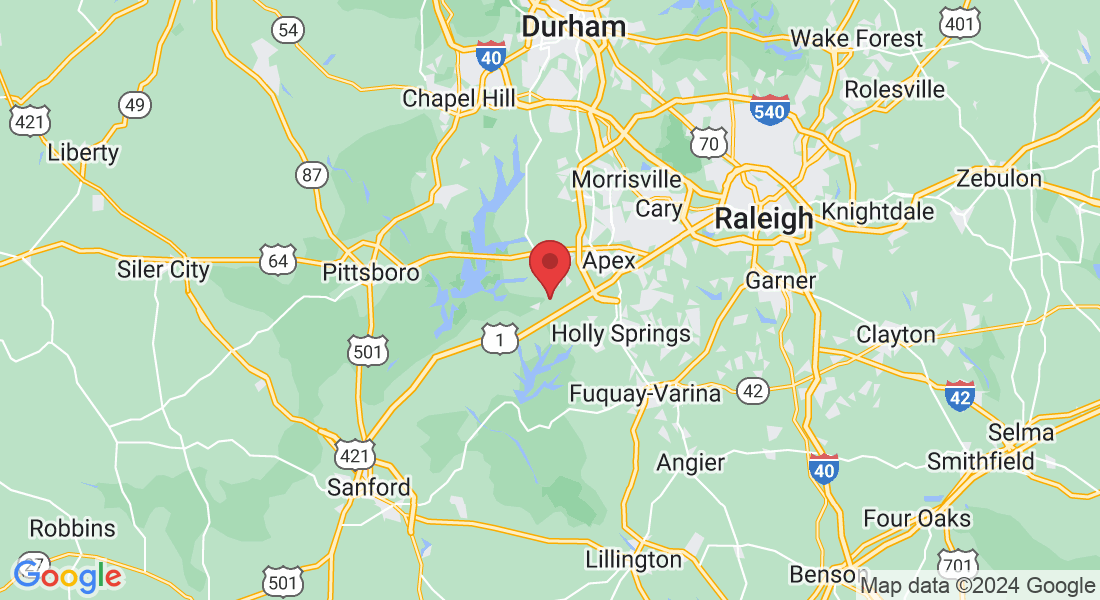

For 2024, the FHA loan limits in North Carolina reflect a mix of standard and increased limits based on the county. Most counties have a standard single-family home limit of $498,257.

However, in certain higher-cost counties, these limits are higher to accommodate the local real estate market dynamics. For instance:

Currituck and Pasquotank Counties have significantly higher loan limits due to their proximity to the Virginia Beach-Norfolk area, with single-family home limits reaching up to $805,000.

Durham and Orange Counties, part of the much sought after Triangle Region, also see higher limits, with a single-family loan limit of 602,600.

Raleigh-Cary metro area, which includes Johnston and Franklin Counties, the limit is set at $529,000 for a single-family home.

These adjusted limits help accommodate the higher real estate prices in these metropolitan or suburban areas, making FHA loans a viable option for a broader range of homebuyers in various parts of the state.

Taking the Next Step

How do you know if an fha mortgage right for you?

Ready to explore FHA loans? They offer a practical route into homeownership with manageable requirements and costs. Whether you're buying your first home or looking to leverage FHA benefits, start by reaching out to our team of expert mortgage loan originators.

While it's important that you know there are options available to you, you can't be expected to know all the ins and outs of every loan program. Fortunately, that's our job. Our loan officers will go over all of the options available to you to help you decide which loan program is the ideal fit for your situation.

Ready to make the leap from endlessly scrolling through Zillow to holding those shiny new keys?

Click or scan that perky little "Get Started" QR Code (you know you want to), or go old-school and give us a ring at 919.646.6869. Because calling someone is so... intimate. Scheduling appointments is the new flirting, didn’t you know? 😉

About Jason Iacovelli

Your Favorite loan officer's favorite loan officer

With over 20 years in the mortgage industry and a rich history of roles—from loan officer to branch manager—Jason has seen thousands of mortgage deals through to closing. A globe-trotter since childhood, he has roots in South Carolina but has called many places home, including Germany and New York, before settling in Cary in 2014.

At home, Jason is a dedicated husband to Valerie and doting father to two. When he's not closing deals or enjoying family time, he's likely on the golf course, catching up on films, working out & practicing mixed martial arts (a hobby he absolutely loves but was absolutely terrible at).

Local Contact Info

Jason Iacovelli

Sr. Loan Officer

NMLS #3370

3149 Zebroid Way

New Hill, NC 27562

Call or Text: 919-646-6869

jason@themortgage.app

Copyright ©2024 | Axen Mortgage NMLS #1660690 AZMB #0944059 Dallas NMLS #2249747

Licensed to Do Business in the State of AZ, AR, AL, CA, CO, DE, GA, HI, ID, IA, IL, KY, KS, LA, MO, MN, MD, MS, MT, NE, ND, NV, OK, OH, TX, TN, UT, WY, WI

© Copyright 2025. TheMortgage.App. All rights reserved.

Debt Does Deals, LLC, doing business as reAlpha Mortgage, is a licensed mortgage broker NMLS #1743790 (www.nmlsconsumeraccess.org).

TheMortgage.App is a marketing brand and not a licensed entity. Jason Iacovelli – Senior Loan Officer – NMLS #3370. Equal Housing Opportunity – We arrange but do not make loans; all loans are arranged through third-party providers.

All loans are subject to credit approval and not all loan programs are available in all states. This is not an offer to extend credit or a commitment to lend. For Texas consumers: Visit the Texas Consumer Complaint Notice for instructions on how to file a complaint with the Texas SML and about the recovery fund.